Unlock Cash From a Life Insurance Policy with No Repayment!

- April 30, 2024

- Life Insurance

Life Insurance to Fit YOUR Needs

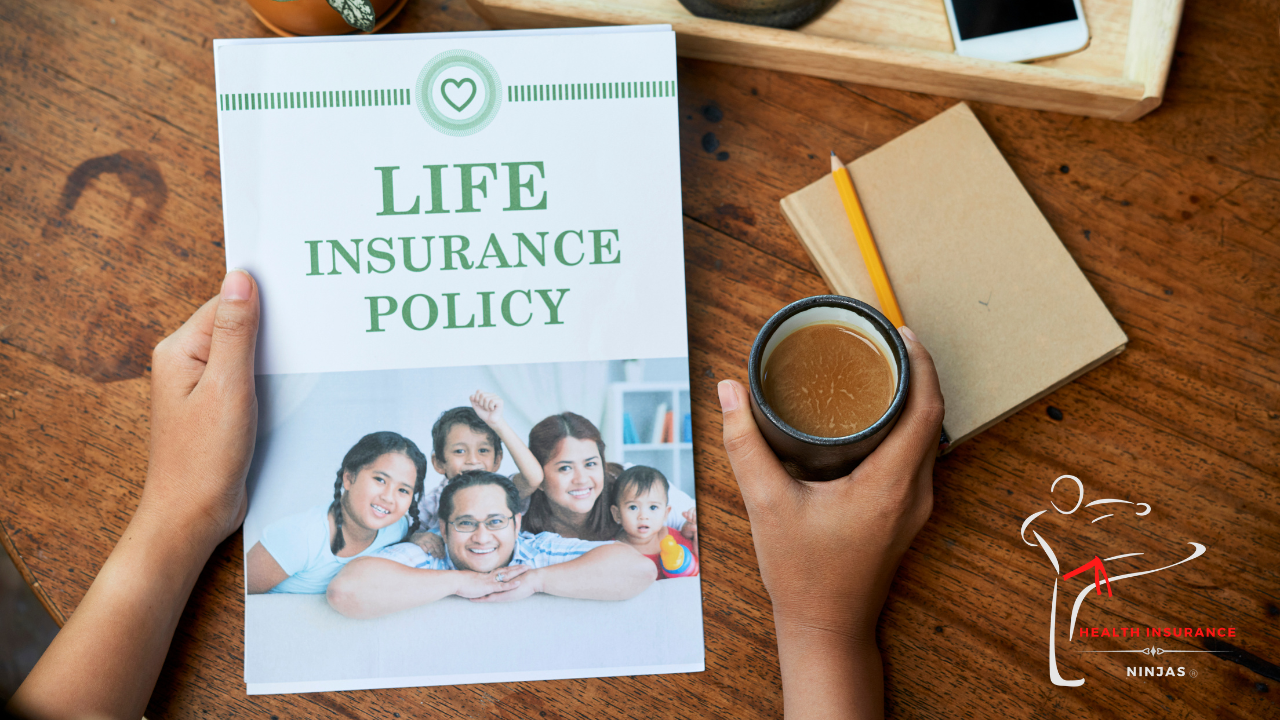

Life insurance policies can provide financial security for your loved ones in the event of your passing. But did you know that some policies allow you to borrow from the cash value of your policy without the need for repayment? While this may sound like an attractive option, it’s important to understand the implications and potential consequences of borrowing against your life insurance policy. In this article, we will delve into the details of how this process works and what you need to consider before tapping into your policy’s cash value.

Benefits of Borrowing From Your Life Insurance Policy

Borrowing from your life insurance policy can provide a quick and convenient way to access funds in times of need. Unlike traditional loans, borrowing against your policy’s cash value typically involves minimal paperwork and no credit checks. Additionally, the interest rates on these loans are often lower than those offered by banks or credit card companies. By utilizing this option, you can maintain your financial flexibility without disrupting your long-term savings goals. However, it’s crucial to borrow responsibly and consider how unpaid amounts, along with interest deducted, may impact the payout your beneficiaries receive upon your passing.

Important Considerations Before Taking Out a Loan

Before deciding to borrow from your life insurance policy, it’s essential to understand the terms and conditions associated with this type of loan. Consider factors such as the interest rate, repayment schedule (if there is one), and the impact on your policy’s cash value and death benefit. Evaluate your financial situation and ensure that borrowing against your policy aligns with your overall financial goals. It’s also advisable to consult with a licensed advisor to assess the potential implications and ensure you make an informed decision. By carefully weighing these considerations, you can make the most of this financial tool while safeguarding your long-term financial security. Stay informed for more key insights on maximizing the benefits of borrowing from your life insurance policy.

Impact on Your Policy's Death Benefit

One crucial aspect to consider when borrowing from your life insurance policy is the potential impact on your policy’s death benefit. Unpaid loan amounts, along with accumulated interest, are deducted from the death benefit payout upon your passing. This reduction in the death benefit can affect the financial security of your beneficiaries. It’s essential to weigh the benefits of accessing cash value against the long-term implications on your loved ones’ financial well-being. Stay informed about the specifics of your policy to make well-informed decisions that align with your overall financial strategy. For personalized guidance, consult with a licensed advisor to navigate these complexities effectively. Stay tuned for more valuable insights on optimizing your life insurance policy.

Consulting with a Licensed Advisor

A licensed advisor can provide personalized guidance tailored to your specific financial goals and circumstances. They can help you understand the implications of borrowing from your policy’s cash value and how it may impact your overall financial strategy. By working with a professional, you can make well-informed decisions that align with your long-term objectives and ensure the financial security of your loved ones. Schedule a consultation with a financial advisor to navigate the complexities of borrowing from your life insurance policy effectively. Stay informed and empowered in managing your financial future.

Final Thoughts on Utilizing Your Life Insurance Policy's Cash Value

Utilizing your life insurance policy’s cash value can provide a valuable source of funds in times of need. However, it is important to approach this option with careful consideration and awareness of the potential implications. By consulting with a licensed advisor, you can gain insights into how borrowing from your policy may impact your financial standing and long-term objectives. Remember that any unpaid amounts, along with interest, will be deducted from the payout upon your passing. Striking a balance between leveraging your policy’s cash value and ensuring the financial security of your loved ones is key. Take the time to evaluate your options thoughtfully and make informed decisions that align with your financial goals.

Connect with an Insurance Ninja today learn more about Long-Term Care BEFORE you need it.

Life Insurance

Ensuring the financial futures of those you love. Explore Term, Whole, and Universal options with the Insurance Ninjas to determine best solution for YOUR needs.

Stay in the Ninja News Loop!

Subscribe to our monthly newsletter & receive all our free resources once a month in your Inbox.

Check Us Out!

Delays In LTC Benefits Review: What You Need To Know

Long-Term Care (LTC) Resources for Your Needs AND Your Parents Long-term care, often ignored in healthcare discussions, is essential for those with chronic conditions, disabilities,

Medicare: Why You Need To Know Your ABC’s & Don’t Forget D

MediCare Solutions You Can Use Medicare is a critical program that provides health insurance for millions of Americans, particularly those aged 65 and over. Understanding

Financial Security Made Easy: LTCI Level Premiums Explained

Long-Term Care Resources for Your Needs AND Your Parents One of the biggest concerns for individuals as they age is maintaining financial security, especially when